What is e-Wallet?

E-wallet stands for electronic wallet. It is a type of electronic card which is used for transactions made online through a computer or a smartphone. The utility of e-wallet is same as a credit or debit card. An e-wallet needs to be linked with the individual's bank account to make payments. The main objective of e-Wallet is to make paperless money transaction easier.

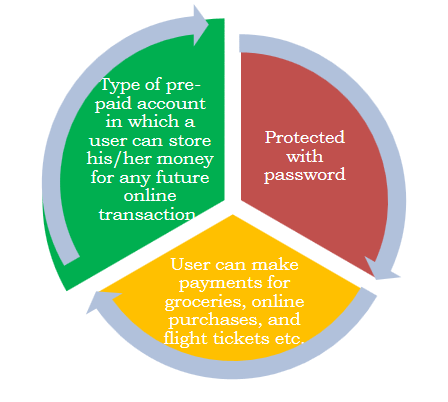

Features of e-Wallet

How does it work?

E-wallet has mainly two components, software and information.

Software component stores personal information and provides security and encryption of the data whereas information component is a database of details provided by the user which includes their name, shipping address, payment method, amount to be paid, credit or debit card details, etc.

How do I use e-Wallet?

For Consumer

- Download the app on your device.

- Sign-up by entering the relevant information. The user will receive a password.

- Load money using debit/credit card or Netbanking.

- After shopping online, the e-wallet automatically fills in the user's information on the payment form.

- Once the online payment is made, the user is not required to fill the order form on any other website as the information gets stored in the database and is updated automatically.

For Merchant

- Merchant downloads the app on his/her device.

- Sign-up by entering the relevant information. The user will receive a password.

- Self-declare yourself as a merchant.

- Start accepting payments.

What do I need to start using an e-wallet?

- Bank Account.

- Smart phone.

- 2G/3G/4G connection.

- A free wallet app .

Must Do Practices

- Register your mobile number at bank for regular information by SMS for every transaction .

- Never share your PIN to anyone.

- Transact at only trusted merchants.

- While at ATM, ensure no one is looking over your shoulder.

What is a POS (Point of Sale)?

Point Of Sale Definition: A Point of Sale (POS) is technically a system in a retail store from which you conduct the sale of physical goods. In a store, a POS is where the checkout happens, orders are processed and bills are paid.

Understanding Point of Sale (POS) Terminology

People often wrongly use the terms a) POS, b) Point Of Sale System, c) POS Software and d) Point Of Sale Terminal interchangeably. We will work on explaining all the three concepts clearly first so you can follow the rest of this article with greater clarity.

1. POS System

A POS System is the overall hardware and software system used for billing in a POS Store. It usually consists of the following units for displaying the order total, product weight, etc. and other hardware units for scanning product barcodes, a printer for receipts and a cash register.

In today’s times, card readers have also become an integral part of a POS system.

Here’s what a POS system typically contains:

- A display unit to show the billing

- A keyboard/touchscreen device to select products and enter data

- Barcode scanner to scan billed objects

- A Printer to print the receipt

- Cash register – for storage of cash obtained during sales

- A software interface to complete the process

2. POS Software

The Software that runs on the POS System is what is usually referred to as the POS Software. Much like your laptops that run on Windows or Mac, or your phones that run on Android or iOS, a POS software serves as the terminal’s operating system.

In the POS software interface, you can input data about the products that you will sell, tally order costs and transact financially. The POS software helps you to process orders in a retail store with the help of available hardware.

Many large retailers use POS software that has been custom-built for their specific needs. As you can imagine, POS software solutions are as diverse as the needs of the retail industry. Even hotels use a variant of a basic POS software algorithm to accept bookings, allot rooms and bill their guests.

3. POS Terminal

A POS (Point of Sale) terminal is a card reading machine or any other device that accepts payments for an order placed on the POS system. These machines may or may not be integrated with the POS Software.

You may have noticed that in some stores, the bill is printed and the card swiped on a single hardware device. These terminals are usually built into the system as a whole and are integrated with the POS software for seamless order management and faster checkouts.

POS terminals usually detect all modes of payments over swipe and chip-based cards- after all, that’s what they were built to do! Modern POS Terminals also detect NFC/ contactless cards and other payment options such as Apple Pay, Google Wallet, Samsung Pay, etc.

POS software is integrated with Square for payments when you use our iOS app for processing your POS orders.

4. POS Payments Explained

A point of sale purchase or payment is the specific point in time when a financial transaction takes place through a POS system.

For example, if you decide to buy two products and take them to the checkout counter, the staff there would scan the products and create a receipt.

How To Set Up A POS System?

Setting up a Point of Sale (POS system) involves setting up the hardware, software and the terminal. Let us go through each step in the same order.

1. Hardware Installation

POS hardware has two components that you cannot get rid of. They are the barcode scanner and the display unit. Both these devices are needed to scan a product and view the transaction, respectively. Apart from these, here are some other components to consider:

- Power Backup: If you choose to install the full setup including desktop devices, consider investing in a UPS to prevent data losses during a power cut.

- Connecting the components: Connect your hardware components to each other, and to the internet. If you will use a cloud-based POS, internet access is a must.

- Using an iPad POS: Primaseller works on a browser, or through the application. If you use an iPad in your store as the POS hardware, Primaseller helps you use the camera for product scanning and Square for payments, thus consolidating all POS components into one device.

- Printing receipts: You can connect the iPad or POS system to a printer of choice, choose a receipt template and start printing. Also, why not go green and just email the template instead? This way, you also get a hold of the customers’ email addresses to send promotions to.

2. Software Setup

Depending on whether you choose a native POS or a cloud-based software product, these next steps will vary slightly.

- Native POS: Personnel from the service provider’s company usually come in to install it on your systems and give you a demonstration.

- Cloud-based POS: If you are using cloud-based software, the process is much more straightforward. The backend is ready for you and all you need to do is integrate your store’s database with the POS software.

- Primaseller’s iPad POS: If you use Primaseller’s iOS app on your iPad, setup is simply about logging into your Primaseller account and choosing your templates, as well as updating inventory for the first time.

1. What is Internet Banking?

Internet banking, also known as online banking or e-bankingor Net Banking is a facility offered by banks and financial institutions that allow customers to use banking services over the internet. Customers need not visit their bank’s branch office to avail each and every small service. Not all account holders get access to internet banking. If you would like to use internet banking services, you must register for the facility while opening the account or later. You have to use the registered customer ID and password to log into your internet banking account.

2. Features of Online Banking

- Check the account statement online.

- Open a fixed deposit account.

- Pay utility bills such as water bill and electricity bill.

- Make merchant payments.

- Transfer funds.

- Order for a cheque book.

- Buy general insurance.

- Recharge prepaid mobile/DTH.

3. Advantages of Internet Banking

The advantages of internet banking are as follows:

- Availability: You can avail the banking services round the clock throughout the year. Most of the services offered are not time-restricted; you can check your account balance at any time and transfer funds without having to wait for the bank to open.

- Easy to Operate: Using the services offered by online banking is simple and easy. Many find transacting online a lot easier than visiting the branch for the same.

- Convenience: You need not leave your chores behind and go stand in a queue at the bank branch. You can complete your transactions from wherever you are. Pay utility bills, recurring deposit account instalments, and others using online banking.

- Time Efficient: You can complete any transaction in a matter of a few minutes via internet banking. Funds can be transferred to any account within the country or open a fixed deposit account within no time on netbanking.

- Activity Tracking: When you make a transaction at the bank branch, you will receive an acknowledgement receipt. There are possibilities of you losing it. In contrast, all the transactions you perform on a bank’s internet banking portal will be recorded. You can show this as proof of the transaction if need be. Details such as the payee’s name, bank account number, the amount paid, the date and time of payment, and remarks if any will be recorded as well.

What is online bill payment?

Online bill payment is a secure electronic service that allows customers to pay bills without having to write checks and mail them. Online bill payment usually is tied to a checking account from which funds are withdrawn electronically for payment of one-time or recurring bills. Online bill payment is offered by many banks and bill-pay services.

0 Comments